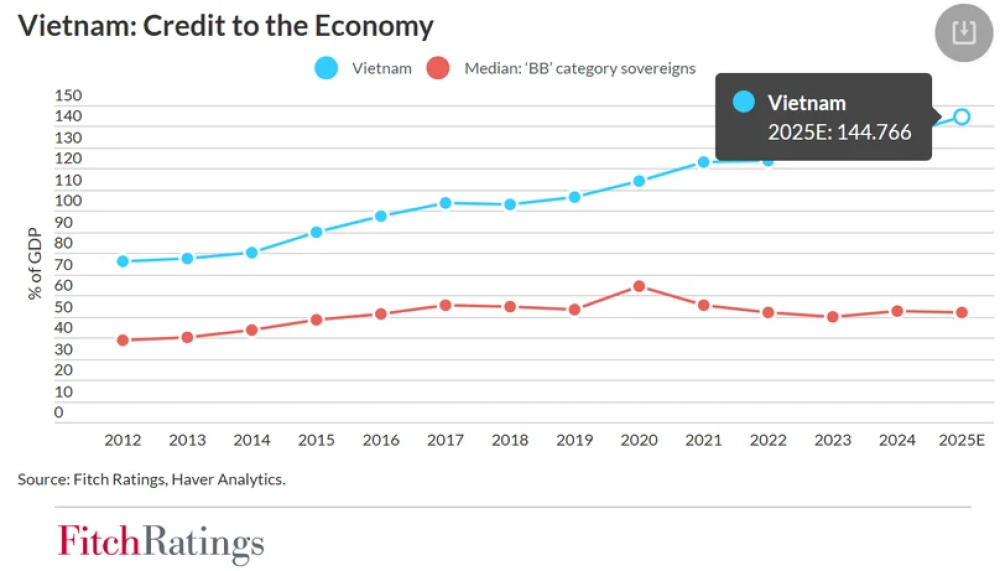

Vietnam's credit-to-GDP ratio at 145%, tripling 'BB' peers' median of 52%

Vietnam's credit growth of 19.1% in 2025 increased from 15.1% in 2024, lifting the country's credit to the economy to 145% of the GDP by end-2025, Fitch Ratings said in a Wednesday commentary.

145% is almost triple the median of 52% for other countries with similar long-term foreign-currency issuer default rating (IDR) at "BB", the credit rating agency stressed.

While rapid credit growth can boost activity in the short term, it can also steer lending into low-return or speculative uses, which can inflate asset prices and raise the risk of a later correction that can hurt banks, investment and overall growth. These dynamics are a key constraint on the sovereign credit profile even if near-term growth remains strong, according to Fitch.

The State Bank of Vietnam, the country's central bank, has set a 2026 credit growth target of 15%, below the 2025 outcome. There remains a risk that the target could be lifted materially, to support the ambitious growth objectives, as the authorities did in 2025, causing a faster build-up of leverage, it noted.

Fiscal stimulus could be another option the authorities might explore if growth falls short of the target. Vietnam’s general government debt remains lower than the ‘BB’ median of 51.4%, and Fitch expects it to rise to 33.5% in 2026 from an estimated 32.6% in 2025, partly due to stepped-up public infrastructure spending.

Besides, Fitch pointed out that To Lam was recently confirmed the General Secretary of the Communist Party of Vietnam for a second term. The leadership will likely support effective execution of policy priorities, including lifting productivity through support for technology and innovation, greener growth and continued infrastructure spending.

Source: Tri Duc

Photo: Photo courtesy of Vietnam News Agency