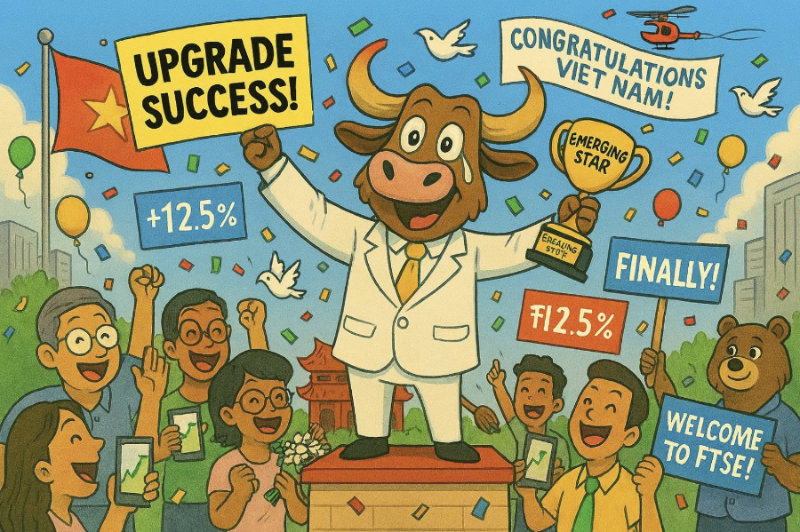

FTSE Russell announces the upgrade of Vietnam's stock market

Once upgraded, Vietnam's stock market will officially be included in the investment portfolios of hundreds of global ETFs and active funds, especially those tracking the FTSE Emerging Markets Index.

FTSE Russell officially announced the upgrade of Vietnam’s stock market classification from Frontier Market to Secondary Emerging Market on October 8.

The reclassification will take effect on September 21, 2026, subject to a provisional assessment during the next review in March 2026.

The purpose of this evaluation is to determine whether sufficient progress has been made in facilitating access for global investors and meeting the needs of the international investment community. “The reclassification of Vietnam to Secondary Emerging Market status is expected to be implemented in multiple phases,” stated the FTSE Russell Index Governance Board.

FTSE Russell will continue to closely monitor developments and welcomes feedback from stakeholders regarding the index before conducting the provisional country classification review in March 2026, to ensure the reclassification proceeds as planned in September 2026.

Vietnam was previously classified as a Frontier Market and has been on the watchlist for an upgrade to Emerging Market status since September 2018.

The FTSE Russell Index Governance Board (IBG) acknowledged the progress made by Vietnamese market authorities in developing the market and confirmed that Vietnam has met all the criteria for Secondary Emerging Market status under the FTSE Equity Country Classification framework.

Commenting on the upgrade, Director of Retail Client Analysis at Yuan Securities Nguyen The Minh described it as a historic milestone, marking over two decades of development and integration of Vietnam’s financial market.

The upgrade is not only a technical recognition by international rating agencies such as FTSE Russell and MSCI, but also a testament to Vietnam’s extensive reform efforts in improving its legal framework, upgrading trading infrastructure, and enhancing transparency to meet international standards.

Once upgraded, Vietnam's stock market will officially be included in the investment portfolios of hundreds of global ETFs and active funds, especially those tracking the FTSE Emerging Markets Index. This influx of large-scale capital is expected to boost liquidity, improve valuations, and enhance the credibility and appeal of Vietnam’s market in the eyes of institutional investors worldwide.

Moreover, the upgrade is anticipated to have a broad and positive impact on the structure and quality of the market.

Source: An Nhiên

Photo: Illustrative image